OVERVIEW

Yesterday I was clever, so I wanted to change the world. Today I am wise, so I am changing myself .

– Rumi

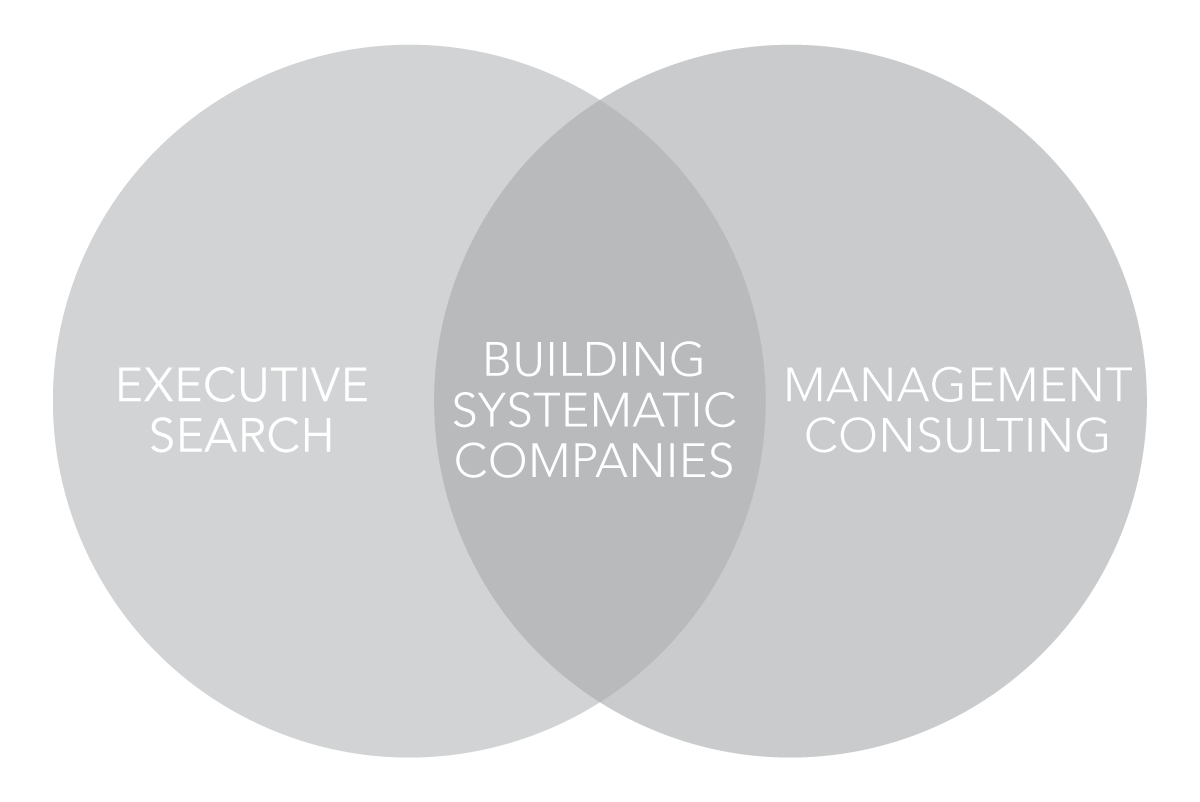

In 2020, I founded Cambio Systematic LLC to continue my long-term focus on executive search for systematic investing and to formally expand into the research-based consulting services traditionally offered only to long-standing search clients.

I chose cambio, the Spanish word for change, to reflect my personal belief in the value of transformation. The ability to adapt has never been more important in this challenging environment for systematic investing.

Cambio Systematic will function as a successor to Scott-Bennett Inc., the company founded over twenty-five years ago by three partners with a shared goal: to build a search firm that upended the traditional high-volume model driving the economics of the retainer search industry.

At Scott-Bennett, we believed that clients were best served when all aspects of a search assignment were conducted by senior professionals with extensive and highly specialized experience. The philosophy worked, the firm was a success, and each partner developed an in-depth knowledge of the asset management industry. I chose Systematic Investing as my field of expertise, while Susan Taylor and Ellen Klein became specialists in Wealth Management and Fundamental Investing.

In 2020, Scott-Bennett Inc. was restructured. Cambio Systematic LLC was created, Susan Taylor founded Scott-Bennett LLC to focus on wealth management, and Ellen Klein retired.

ADVISORY COUNCIL

I get by with a little help from my friends.

– Lennon & McCartney

I have been quite lucky in my career. Early on, as I struggled to understand the academic literature that would become a critical component of my search process, many generous quants came to my rescue.

People like Mark Carhart, Sebastian Ceria, Richard Grinold, Roy Henriksson, Jim Scott, and Bill Sharpe provided invaluable feedback to shape my understanding of the industry and guide my search efforts.

The Advisory Council of Cambio Systematic will serve a similar function and will be an ongoing resource for the benefit of our clients. It is composed of former executives and thought leaders in the worlds of systematic investing and technology, many of the same people who over the past twenty-five years have played informal, yet instrumental roles as advisors to my search practice.

Members of the Advisory Council have traded in their C-Suite responsibilities to focus on their own investment portfolios. At Cambio Systematic, they will serve two primary functions:

- To continue to advise me in my traditional search practice, vetting papers, people, strategies, and companies, all to the benefit of my clients.

- To apply their knowledge and experience to the analysis of up-and-coming systematic investment firms that have passed my own initial vetting process. The goal is to assist each firm in building its business through direct investment or indirect assistance.

I am honored that these friends and colleagues have agreed to provide their expertise. They will function as an expert network augmenting the company's understanding of the key people, investment strategies and organizations that represent the future of the systematic investment industry.

- Peng Chen – Former CEO Asia ex-Japan, Dimensional Fund Advisors. Former President, Global Investment Management Division, Morningstar. Former President, Ibbotson Associates.

- Peter Chirlian – Former CEO, Armanta. Former Head of Financial Strategies Group, Prudential Financial. Former Global Head of Fixed Income Electronic Trading, Goldman Sachs.

- Mike Even – Former Chairman and CEO, Man Numeric. Former Co-Head and Global CIO, Citigroup Asset Management. Former CIO, Citigroup Private Bank.

- Blake Grossman – Former CEO, Barclays Global Investors

- Kent Clark (December 13, 1964 to January 27, 2023)

Quants don’t always agree; they love to debate, to challenge ideas. For the many years I had the privilege of knowing Kent, I had only seen absolute agreement across the broadest spectrum that he was not only brilliant, but one of the kindest and most generous people in the industry. Over the past two years, I had the opportunity to work closely with Kent, seeing these characteristics first-hand. I can only repeat what everyone has said since his tragic accident and death – that it is heartbreaking and a tremendous loss of a great soul.

BOB shainheit

Lightbulb moments guide the path to the future. One of my seminal moments occurred early in my career, during a search I was conducting for Marty Leibowitz’s Bond Portfolio Analysis Group at Salomon Brothers, a pioneering think-tank in the field of quantitative investing.

This occurred after graduation from Columbia Business School and a stint in Management Consulting at what is now Ernst & Young. I was starting out in the search industry, trying to determine if I had a chance of succeeding in a field that seemed to place inordinate emphasis on business generation as a function of outside social activities, not one of my strong suits.

To my rescue came the quants, many of whom seemed to share my obsessive/compulsive traits, as well my research orientation, albeit with a different definition of research. The problem was that they seemed to speak a different language.

To understand this new language required studying the academic literature, at a time when the internet and SSRN were non-existent. However, after many days in the library, followed by discussions with the authors, the clouds parted, and my path was set via a series of illuminations:

- Quants valued research and were predisposed to imparting knowledge on the uninformed (me).

- Transparency was critical for accessing this universe of thought-leaders, and admissions of ignorance were positively received.

- Discussions with quantitative academics represented a critical entry point to a path that traversed the sell-side, buy-side, pension consulting and plan sponsor universes.

- The value of the proprietary data gathered along each step of that path was immense. That data—on people, products, companies, market trends, etc.—would be of enormous value to me in conducting my searches and to my clients in helping manage their businesses.

Armed with these insights, I spent years traversing the country, with occasional international trips. I followed the path that served as a connector to the different thought leaders, meeting the best and brightest in the world of systematic investing.

I finally spoke the language of the quants, and the discussions became the foundation for my database and my business. They also became the foundation for relationships that exist to this day.

My next lightbulb moment? The realization that organizational structure could either enhance or devalue the information gathered. It led to the decision to join forces with two partners in a start-up search firm, Scott-Bennett Inc., based on the belief that a volume-based structure provided clients with inferior results.

After twenty-five years, we dissolved the partnership, and I founded Cambio Systematic to continue my work serving the systematic investment community.

CONTACT

To contact Cambio Systematic, please email:

info@cambiosystematic.com