CORE PHILOSOPHY

Information is empowering. It is critical to the decision-making process and can provide a significant competitive advantage if used properly.

The most valuable information is proprietary.

The proprietary information gathered during my 25-years recruiting for the systematic investment community represents an accumulated depth of knowledge that transcends boundaries. For me, it has illustrated the connectivity between recruiting and strategic consulting, providing a pathway to better advise my clients and advance their goals.

I also believe that information alone is not enough.

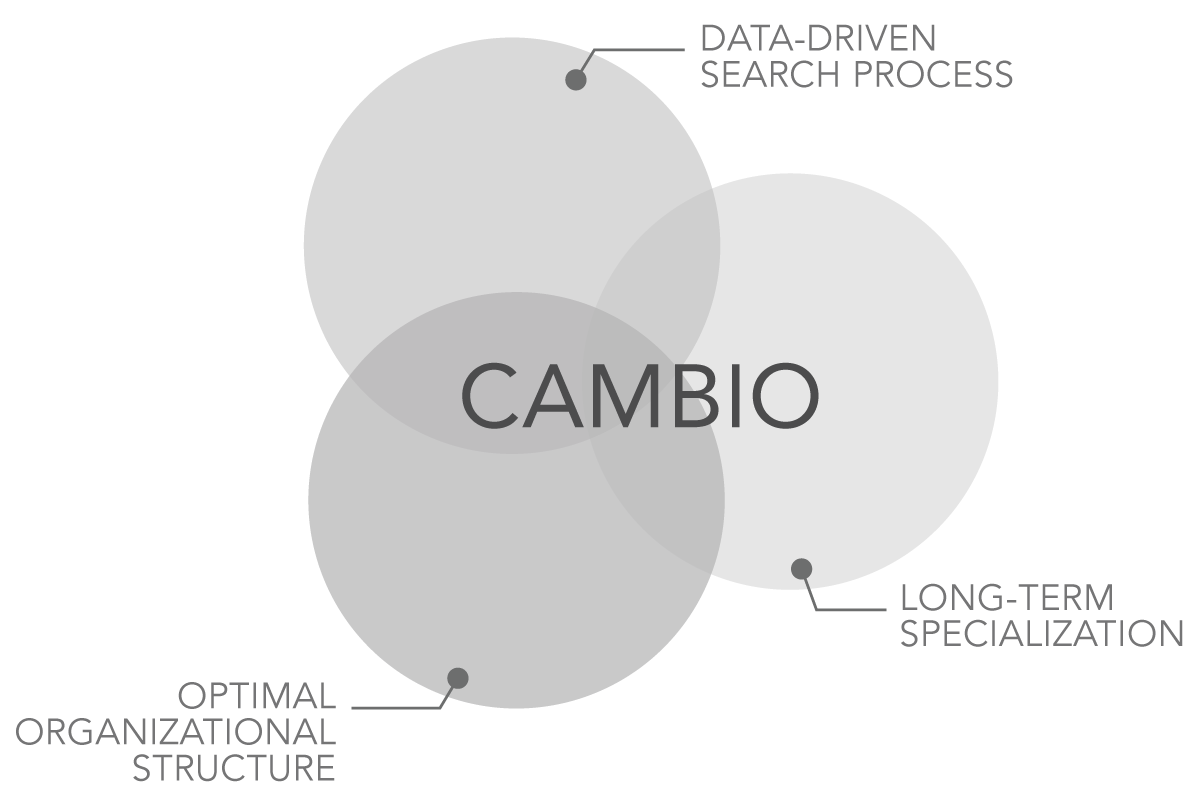

My predecessor firm, Scott-Bennett Inc., was founded with the philosophy that transparency, combined with industry specialization, the right organizational structure, and a research-driven search process would provide the client with the optimal outcome.

Cambio Systematic continues the commitment to that philosophy with a track record of success in recruiting that reflects:

- A decades-long specialization in systematic investing.

- An organizational structure that ensures no delegation of responsibility for any phase of the assignment.

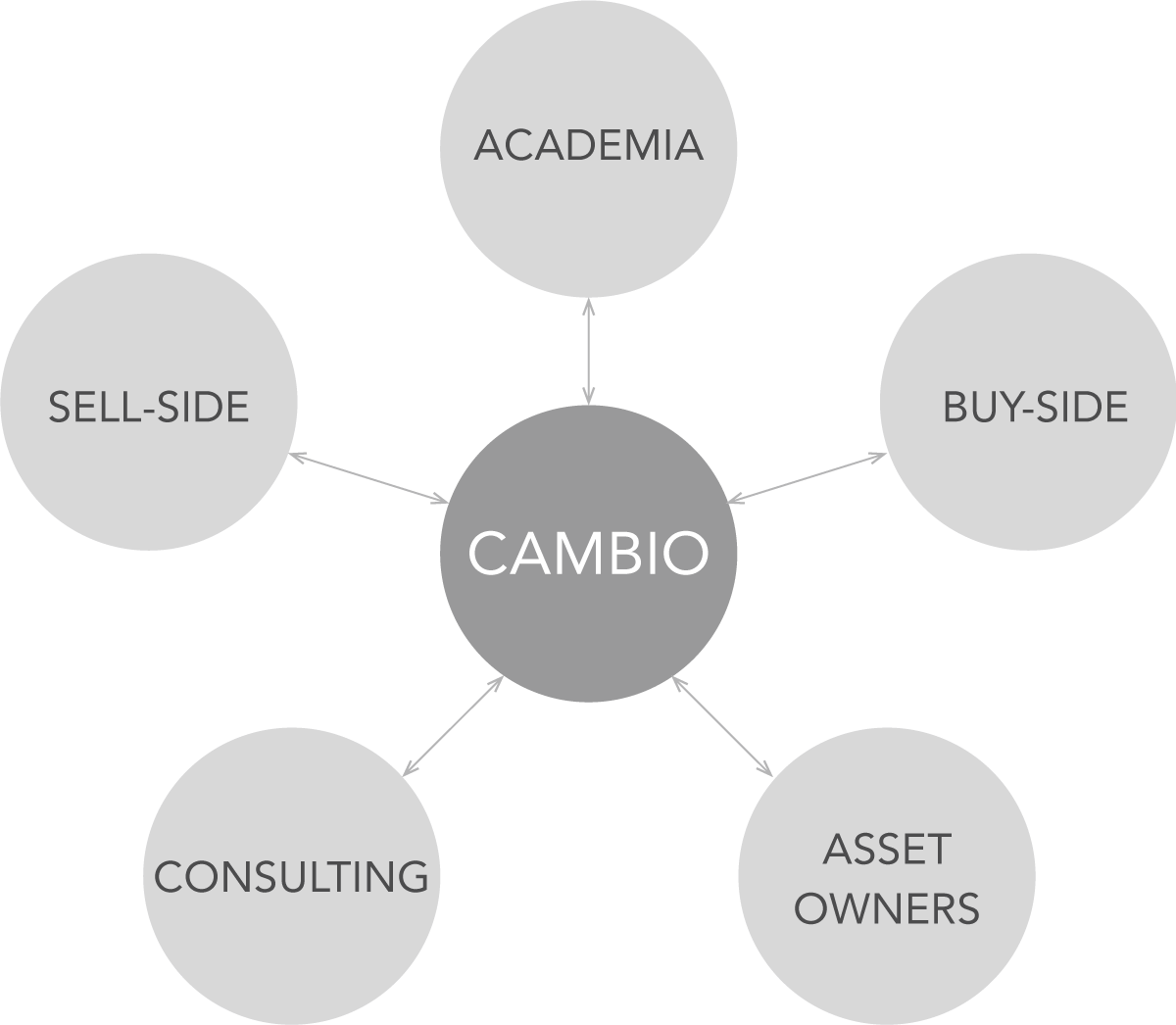

- A state-of-the-art database containing vital reviews of people, companies, products, market trends (etc.). Difficult-to-obtain information gathered over the past twenty-five years from the top thought leaders in academia, buy-side and sell-side firms, pension consulting, and asset owners.

- A process that incorporates this proprietary data into every phase of the assignment.

maximize results for the client or maximize revenue for the search firm?

Strive not to be a success, but rather to be of value.

– Albert Einstein

How many times have you been approached by a recruiter with little knowledge of your current position, your career goals, your company, and the industry in general? The lack of knowledge is symptomatic of a larger underlying problem - an economic model based on volume and leverage dictating an organizational structure that runs counter to the client's interest.

Under this model, senior search consultants with the greatest industry experience provide the volume, functioning as business generators, while managing client engagements. Lower cost support staff function as leverage, conducting research and executing assignments.

The model succeeds in management consulting, but fails in recruiting, where the emphasis on revenue generation dictates that one of the most critical parts of the process be delegated to junior members of the team - the initial call to the candidate.

Combine this failure with the lack of transparency and a bet on adverse selection, and you have a formula for recruiting mediocrity.

In today's challenging environment for systematic investing, the right recruit can be the difference between success and failure.

At The Nexus of Information Flow in Systematic Investing

Data! Data! Data! I can't make bricks without clay.

– Sir Arthur Conan Doyle

Collaborating with clients on strategic organizational issues has always been a key part of our search process. The ability to assist clients in business plan development, to conduct competitive analyses, and to advise on joint venture and M&A projects has been facilitated by the deep-dive company research generated during the search process.

What is this research and why is it so critical?

In recruiting, in-depth company research significantly increases the probability of a successful long-term match between a candidate and a company, a match based on shared values. The company research offered by Cambio Systematic represents a different application of the anonymized, indispensable insights into systematic investment firms captured and maintained over the past twenty-five years in a proprietary database.

The research is high-touch, difficult to acquire, anecdotal in content and accurate.

- Analyses of organizational capabilities; what is being overstated, what is not. The identification of corporate strengths/advantages, as well as corporate dysfunction.

- Information on organizational structure, and the impact, both financial and cultural, of legacy issues.

- Why some competitors successfully retain the best talent while others struggle with attracting and retaining decent performers. What are the underlying issues of high staff turnover?

- Specific examples of management success and failure.

- The true sources of thought leadership and alpha generation, as well as the accurate identification of the key people responsible for developing and commercializing products and revenue streams.

The ability to gather these unique insights is a function of long-standing relationships with thought leaders in systematic investing. By leveraging the opinions of these individuals—the academics, C-Suite executives, buy-side and sell-side quants, consultants, and plan sponsors—we not only assist our clients in recruiting the top talent, we help them to better manage and understand their businesses.

The Right Recruiter with the Right Information asking the Right Questions

The Right Questions

Are you interested in working for XYZ company? Ask enough people the same question, and you'll eventually get a yes. It takes more than a closed-end question to gain the attention of the top systematic candidates with little incentive to make a move.

It takes the right question, supported by the right information in the hands of the right recruiter.

The Right Information

Executive search done properly is a painstaking, time consuming, data-driven process. Company information, and understanding the true culture of an organization, is a vital tool in that process. It is the hallmark of an industry expert, providing the credibility needed to recruit the very same candidate who said no to a less knowledgeable recruiter.

Company information - the story behind the story- is a bridge to building a relationship with even the most reticent candidates.

- A quant shop was losing significant basis points on its long-only product due to implementation issues. Why, and what does it say about the structure and culture of the firm?

- What are the implications of an organization's major marketing push that failed? How does it reflect upon management and the firm's ability to invest in research to support falling investment performance?

- What are the real reasons behind the failure of a quant shop? Is it the Value explanation given by management or is it something more?

- What was the impact on the portfolio of the coding error in the well-known quant shop? What did management's subsequent actions reveal about underlying issues between the subsidiary and the parent company?

Answers to these questions are rarely simple, frequently hidden from public view, and have value for both clients and candidates in business and career planning, respectively. They are also critical elements in determining the true culture of an organization and whether the values of the candidate match the culture of the company.

The Right Recruiter

Recruiting, like investing, is a balance of art and science. Science is represented in the difficult-to-obtain data on people, companies, and products, as well as the organizational structure that puts both data and execution responsibilities in the right hands.

The right recruiter provides the art, using the science to construct a recruitment strategy aimed at providing the client with the optimal solution. It all comes down to the right recruiter, armed with the right information, working in the right organizational structure, asking the candidate the right questions.